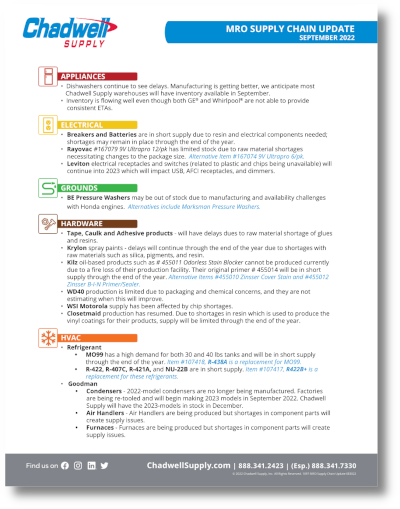

Supply Chain

Supply Chain Update August/September 2022

Updated September 2, 2022

APPLIANCES

- Dishwashers continue to see delays. Manufacturing is getting better, we anticipate most Chadwell Supply warehouses will have inventory available in September.

- Inventory is flowing well despite both GE and Whirlpool providing inconsistent ETAs.

ELECTRICAL

- Breakers and Batteries are in short supply due to resin and electrical components needed; shortages may remain in place through the end of the year.

- Rayovac 9V Ultrapro 12/pk #167079 has limited stock due to raw material shortages necessitating changes to the package size. Alternative Item #167074 9V Ultrapro 6/pk.

- Leviton electrical receptacles and switches (related to plastic and chips being unavailable) will continue into 2023 which will impact USB, AFCI receptacles, and dimmers. Product Update

GROUNDS

BE Pressure Washers may be out of stock due to manufacturing and availability challenges with Honda engines. Alternatives include Marksman Pressure Washers.

HARDWARE

- Tape, Caulk and Adhesive products - will have delays dues to raw material shortage of glues and resins.

- Krylon spray paints - delays will continue through the end of the year due to shortages with raw materials such as silica, pigments, and resin.

- Kilz oil-based products such as # 455011 Odorless Stain Blocker cannot be produced currently due to a fire loss of their production facility. Their original primer # 455014 will be in short supply through the end of the year. Alternative Items #455010 Zinsser Cover Stain and #455012 Zinsser B-I-N Primer/Sealer.

- WD40 production is limited due to packaging and chemical concerns, and they are not estimating when this will improve.

- WSI Motorola supply has been affected by chip shortages.

- Closetmaid production has resumed. Due to shortages in resin which is used to produce the vinyl coatings for their products, supply will be limited through the end of the year.

HVAC

- Refrigerant

- MO99 has a high demand for both 30 and 40 lbs tanks and will be in short supply through the end of the year. Item #107418, R-438A is a replacement for MO99.

- R-422, R-407C, R-421A, and NU-22B are in short supply. Item #107417, R422B+ is a replacement for these refrigerants.

- Goodman

- Condensers - 2022-model condensers are no longer being manufactured. Factories are being re-tooled and will begin making 2023 models in September. Chadwell Supply will have the 2023-models in stock in December.

o Air Handlers - Air Handlers are being produced but shortages in component parts will create supply issues. - Furnaces - Furnaces are being produced but shortages in component parts will create supply issues

- Condensers - 2022-model condensers are no longer being manufactured. Factories are being re-tooled and will begin making 2023 models in September. Chadwell Supply will have the 2023-models in stock in December.

- Braeburn Wifi Thermostat (#107347) will be available in December or January due to a shortage of IC chips. Alternative Item #107346 iDevices Wifi Thermostat.

- Pamlico Air Filters will continue to have extended lead times due to shortage of fiberglass and labor.

PLUMBING

- Insinkerator is focusing on the Badger series of garbage disposals, FWD disposers are not currently being produced. Alternatives include Blazer Maximum Garbage Disposers.

- PVC availability seems to be improving but CPVC and ABS products are not recovering as well due to continued raw materials shortages.

POOL

- Pool supplies will continue to be limited through the end of the 2022 pool season.

- Some products may now come in bags rather than plastic containers.

GENERAL UPDATES – SHIPPING/OVERSEAS ISSUES

- U.S. factories have increased capacity and productivity resulting in a large amount of product shipping faster.

- Labor and staffing shortages persist with most overseas manufacturing.

- Smaller factories, that make components for larger goods like light fixtures, ceiling fans, air conditioners, etc., are shipping products more freely.

- Containers and space on ships have increased. Major cities and ports that were closed due to COVID are open, allowing free movement of goods from factories to ports and maximum container loading capabilities.

- Port productivity remains a hurdle for the U.S. supply chain as billions of dollars of products are at anchor or landlocked. A shift to the use of East Coast ports over West Coast ports created new pressures. Rail and port labor issues are adding to the supply chain challenges.

- Chinese military exercises around Taiwan threaten to further disrupt shipping zones.